Property investment has long been considered one of the best ways to build wealth and achieve financial independence.

But while the prospect of property investing can be exciting, the process is fraught with potential pitfalls—especially for first-time investors. Mistakes, while inevitable in some cases, can often result in financial losses, stress, and even long-term consequences.

To set yourself up for success, it’s crucial to understand the common missteps and how to avoid them. Let’s explore the top six mistakes made by first-time property investors and strategies to steer clear of them.

- Lack of Research and Planning

- Overstretching Financial Resources

- Emotional Decision-Making

- Choosing the Wrong Location

- Underestimating Property Management

- Buying an Older Property

Lack of Research and Planning

One of the most critical mistakes first-time property investors make is jumping into the market without thorough research and planning. Investing in property is about more than just purchasing a house and waiting for its value to skyrocket. Key considerations include understanding market trends, vacancy rates, rental yields, and local development plans.

How to Avoid This Mistake

Start with comprehensive due diligence. Research the areas you’re interested in, understand the demographics, and study property values over time.

Download the Retirement Riddle Guide

Overstretching Financial Resources

Many first-time investors underestimate the true costs of property investment. Beyond the purchase price, expenses like, maintenance, insurance, and property management fees can add up quickly.

How to Avoid This Mistake

Determine your budget and stick to it. Work with financial experts to understand your borrowing capacity and the potential cash flow of the property. Always factor in unexpected costs, setting aside a reserve fund for emergencies or repairs.

Emotional Decision-Making

Buying a property for investment purposes is different from purchasing a home for personal use. However, first-time investors often allow emotions to guide their decisions, leading them to choose properties that appeal to their personal tastes rather than focusing on market demand or potential returns.

How to Avoid This Mistake

Approach property investment with a business mindset. Evaluate properties based on quantifiable factors such as rental yields, location appeal, and growth potential. Detach your personal preferences and make data-driven decisions.

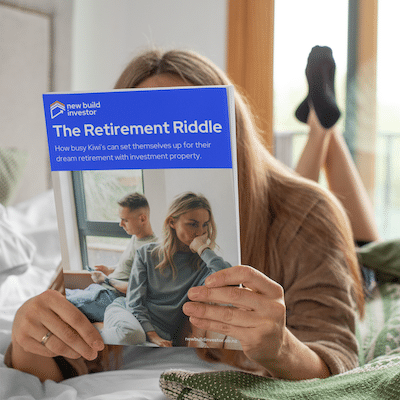

Choosing the Wrong Location

The location of a property is one of the biggest factors influencing its value and rental appeal. First-time investors sometimes prioritise affordability over location quality, which can result in poor returns, low tenant demand, or difficulty selling the property in the future. Places, like Wellington, that have declining populations and a reliance on certain industries (government, forestry, or mining) need to be taken into account.

How to Avoid This Mistake

Prioritise locations with strong market fundamentals such as proximity to schools, public transport, amenities, and job markets. Look for areas with growth potential, such as emerging neighbourhoods with planned infrastructure projects.

Which Investment Property Strategy suits you?

Underestimating Property Management

Purchasing a property is just the beginning. Managing it effectively—finding reliable tenants, handling maintenance, and ensuring compliance with legal requirements—is crucial for sustained success. Many first-time investors underestimate the time and effort property management involves, leading to operational challenges.

How to Avoid This Mistake

If you don’t have the time or expertise to manage the property yourself, consider hiring a professional property management company. They can handle tenant screening, rent collection, and ongoing maintenance, allowing you to focus on other aspects of investing.

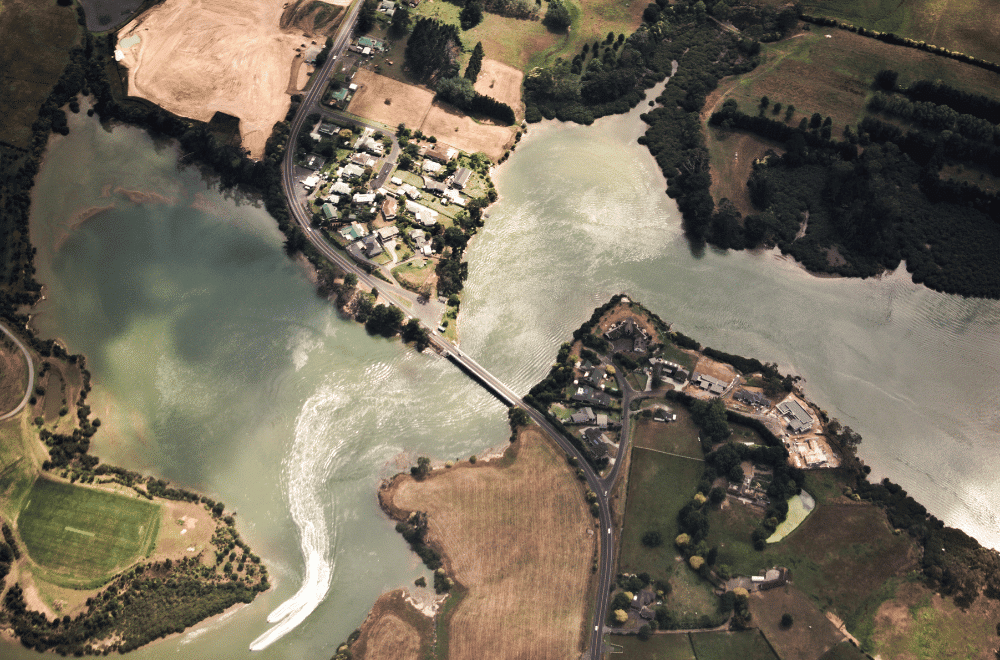

Buying an Older Property

Many first-time investors think the best strategy is to purchase an older, cheaper property and look to renovate to add-value. Whilst this may have worked in the past this strategy is becoming more difficult to execute.

How to Avoid This Mistake

Nowadays, you can purchase a brand-new investment property and become a hands-off investor. That is called a Passive Buy and Hold strategy. Buy a great new property and engage a good property manager to look after the tenants.

Final Thoughts

While property investment offers significant opportunities, it’s not without its challenges. By educating yourself and avoiding these common mistakes, you can reduce the risks and build a portfolio that delivers long-term success. Remember, preparation, research, and professional guidance are your greatest allies in becoming a savvy property investor. Stay informed, remain disciplined, and always prioritise financial sustainability over quick wins.

Want to learn more? Book a call with an expert property investment specialist and start your journey to retirement through property: