New Build Investing

for Kiwi's

Secure your retirement with New Build Property Investments. Future-proof with low-maintenance, high-yield real estate with verified and trusted build partners.

Our Build Partners

Where Investors Get Stuck

Traditional property investments can be time-consuming, high-maintenance, or in declining areas.

Without the right strategy, it’s easy to miss out on the stable, long-term income needed for a comfortable retirement.

Many investors feel stuck between risky ventures and slow returns — while time keeps ticking.

Future-Proof Your Retirement Income

New build properties offer a modern, low-maintenance path to retirement wealth.

Strategically located for growth and built to attract high-quality tenants, they deliver reliable rental income and capital appreciation ideal for hands-off investors planning ahead.

Our team sources premium developments and offers end-to-end support — helping you build a future-proof portfolio.

The numbers speak for themselves

$#####

in Retail Sales

##

Years in Business

###+

Team Nationwide

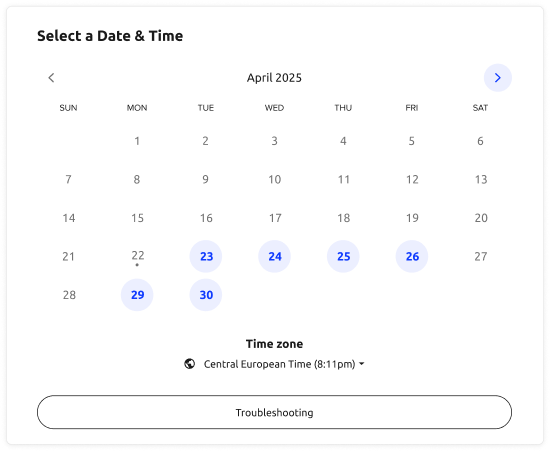

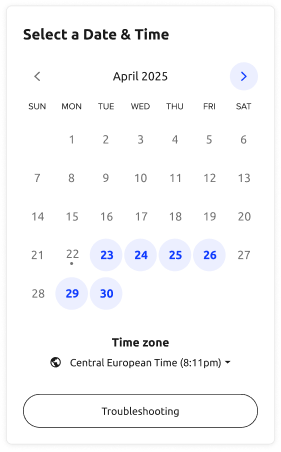

How Much Could You Borrow?

Use our Usable Equity Calculator to see how you can leverage your existing home to build a property portfolio.

You're Pre Approved...

Now What?

Turn your pre-approval into a smart property investment.

Download our free checklist to take the next step with clarity and confidence.

The Retirement Riddle Guide

Download the guide and learn how you can take advantage of the equity in your home to build your retirement nest egg through verified and secure new build investment homes.

Our 8 Step Proven Process

Frequently Asked Questions

Is property investing risky?

Like any investment, there are risks—but with the right property, in the right area, and a clear plan, those risks can be managed. New builds help reduce many of the typical issues like maintenance costs or compliance headaches, making them a safer, more predictable option for long-term investors.

Do I have to manage the property myself?

Not at all. Most of our clients use professional property managers to handle tenants, maintenance, and paperwork. It’s a completely hands-off approach—so you can focus on your career and lifestyle while your investment works for you in the background.

How many properties should I own for retirement?

While everyone’s goals are different, we believe many Kiwis are just three well-bought properties away from a financially secure retirement. The key is quality over quantity—owning the right type of properties, in growth areas, with the right support behind you.

How do you make money with investment property?

You earn in two main ways: rental income (which provides ongoing cash flow) and capital growth (as the value of the property increases over time). If you’re leveraging with a mortgage, your returns are based on the total property value—not just your deposit—helping you grow wealth faster.

What’s the minimum deposit for an investment property?

For new build investment properties, the minimum deposit is typically 20%, compared to 30% for existing homes. This lower barrier to entry is one of the key advantages of investing in new builds—allowing you to get into the market sooner and use your capital more efficiently.

Testimonials

A massive thank you to Hamish (and Jordan) for supporting us (very patiently!) with the purchase of our investment property. We have appreciated your great comms throughout, your honesty, humour and dedication to help us onto the investment ladder.

Hamish and Equiti made our property buying process seamless. They aided in finding the right new build for our portfolio from a reliable developer. Their expertise and dedication were top-notch. Highly recommend!

Hamish and the team demonstrated exceptional knowledge in property investment and were incredibly professional and communicative throughout the entire process. They were attentive to my needs, showed genuine care guiding me meticulously through every step, I am extremely satisfied with the service I received and would highly recommend

Working with Hamish and the team at equiti was a fantastic experience. He responded quickly to all of our queries and ensured nothing was ever a problem. Thanks to their dedication and expertise we secured a great deal. Better than going direct to the developer. Highly recommend!

We had a brilliant experience navigating the purchase of our first investment property. Given we were novices, they gave us a great understanding of the things we needed to consider before making a decision and was very responsive when we had questions. We really appreciated the honesty and transparency that Hamish and the team provided throughout the process.

equiti made the process of purchasing our investment property simple and stress-free. Hamish’s regular check-ins, willingness to share his time and expertise, and proactive support were invaluable. When an unexpected change arose just before going unconditional, Hamish helped us promptly and proactively find a solution that exceeded our expectations. We’ve been very happy with the level of service and follow-up afterwards.

Buying an investment property was a new experience for Gary and I and also a very scary one. However, your professional manner and knowledge shone through. I would certainly not hesitate to recommend you to my friends or family. Surrounding myself with good people like you is the one recommendation I would give to others who were interested in buying an investment property. Thank you again, and I hope to work with you in the future

I recently bought my first investment property through equiti and worked with Hamish throughout. He provided excellent advice, great service, and made the whole process stress-free. I was able to leverage equiti’s strong relationships with developers and builders, securing the best deal and making things much easier than going direct. I wouldn’t hesitate to recommend Hamish and the team, and I’ll definitely work with them again.

Existing or New?

Buying new, off the plans property, is one of the best methods of generating wealth, closing your retirement gap, and securing the dream retirement.

The real selling point of buying new build properties is that you’re able to be a

professional property investor, rather than becoming a landlord.

Existing House

- 30% Deposit Required

- Retrofit for Compliance

- Lower Quality Tenants

- Expensive Maintenance

New Builds

- Lower Desposit Required

- Higher Return on Investment

- Easier Access to Lending

- Minimal Capital Maintenance

What Type of Property Should You Buy?

Take our assessment to help you identify the ideal type of property investment based on your unique goals, risk appetite, and personal strengths.

Designed to help you understand your next investment property purchase in just a few minutes you’ll have a clear picture of the investment path that best suits your profile.

H2 Title

Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat.